Japan investment allocations start to rise

Japan exposure in global portfolios has started to rise slightly, data from Bank of America Merrill Lynch has found.

The global managers' survey for October showed while there was still reluctance to buy fixed income in Japan, allocation to Japanese equities had improved "modestly" to a net 3 per cent underweight.

In September, the global fund managers surveyed by Bank of America Merrill Lynch had held a net 8 per cent underweight position in Japanese equities.

According to the study, although there is still some caution about profit condition in the country, a more positive approach by the Bank of Japan (BoJ) has given some investors confidence.

Much of the attraction of Japanese equities is that it is relatively cheap on a valuation basis, but corporate earnings are key if we are to see further recovery here.

The report gave a qualified thumbs-up to parts of the Japanese equity market, stating: "Japan equity investors see better growth and inflation and the BoJ policy as less restrictive.

"The BoJ seems to have been able to avoid a total disappointment by the market when it introduced a new policy framework in its September meeting."

When it comes to what managers have been doing, the study suggested Japan equity investors have reduced allocations in banks and real estate, but increased allocation in insurance companies.

The study also suggested investors were positioning for growth. It said: "Besides, investor positions moved further overweight in industrials and autos and less overweight retail and staples, indicating some rotation from defensives to cyclicals."

Retail investors, however, seem to be a little more cautious, as advisers have revealed.

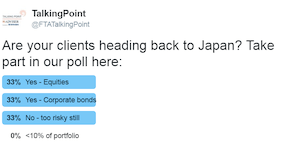

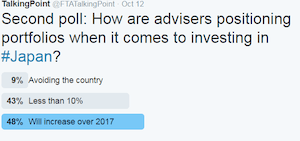

A series of polls carried out by FTA Talking Point suggest 48 per cent of advisers would consider increasing their clients' allocations to Japan over the next year, while 43 per cent said they would increase exposure but no more than 10 per cent of client portfolios.

A separate poll found advisers' opinion was split equally among those whose clients were considering Japanese equities, Japanese fixed income and those whose clients still felt it was too risky.

Ben Willis, head of research for Bristol-based Whitechurch Financial Consultants, said: "The BoJ stimulus has certainly provided a support to stock markets.

"Much of the attraction of Japanese equities is that it is relatively cheap on a valuation basis, but corporate earnings are key if we are to see further recovery here."

Don't be put off Japan: there are long-term opportunities there.

Andrew Rose has been managing and analysing investments in Japan since 1981.

Despite the past couple of decades of economic slowdown, poor bond growth and low investor confidence in this market, Mr Rose believes there are opportunities for investors among small and large-cap Japanese companies, some of which are global leaders in their sectors.

In the video below, he tells FTAdviser's Simoney Kyriakou why he thinks UK-based investors could benefit from going a little bit Japanese in their portfolios.

To learn about the basics of Abenomics

To understand the effect of Japanese policy on the yen

To grasp an understanding of how equity markets react to fiscal policy in Japan

Patience in Shinzo Abe’s unorthodox policies is wearing thin.

Nearly four years ago, Japan’s prime minister vowed to reverse two decades of economic stagnation by introducing a three-pronged strategy of aggressive monetary easing, fiscal stimulus and structural reforms.

Despite some initial success, and media fanfare, sluggish growth, weak inflation and a strengthening currency suggest that his bold, once celebrated “three arrows” have missed their target.

The dwindling popularity of Japanese equities in recent months echoes this crisis of confidence in so-called Abenomics.

At first, Mr Abe’s creative measures succeeded in boosting corporate profits and inching the Nikkei 225 index back towards its previous peak of 1989. But then unhelpful developments in the rest of the world, and an underwhelming response to his latest batch of policies, saw it all go pear-shaped.

Impatient critics began questioning the government’s ability to deliver on its promise of 2 per cent inflation, while dredging up memories of the last time its stock market’s bubble burst.

It is becoming increasingly clear that Japan’s extreme monetary policy has been and remains highly reliant on currency devaluation to achieve its inflation objective.

Not long after, Japanese equities became almost as unpopular to foreign investors as they were when Mr Abe was re-elected back in December 2012.

With his back against the wall, and most of his previously used tools under fire, Mr Abe’s latest attempt in October to restore confidence saw him take a stab at “yield curve control”.

By increasing the difference between yields on short-term interest rates and long-term bonds, banks, in theory, should become more profitable. Much like quantitative easing, the prime minister hoped flooding struggling financial institutions with cash would trigger greater economic activity.

All eyes on the yen

The fact the yen was unchanged on the day of the announcement suggests that this latest measure, like the controversial negative interest rate policy introduced at the beginning of the year, failed to generate the desired response.

Given the country’s heavy reliance on exports, weakening the currency is viewed by many as the principal goal of Mr Abe’s reforms.

Japanese companies sell the majority of their products abroad, so a devalued yen generally gives them a competitive edge when exporting cars and other manufactured goods.

That explains why the recent appreciation of the currency dented sentiment in its equity market and derailed the Bank of Japan’s (BoJ) bid to boost inflation.

“While global markets in the short-term are likely to be supported by the belief that the BoJ remains firmly on an easing track, it is - in our view - becoming increasingly clear that Japan’s extreme monetary policy has been and remains highly reliant on currency devaluation to achieve its inflation objective,” says Alastair George, investment strategist at Edison.

In this regard, the strength of the yen... immediately after the BoJ’s new “yield control” and “inflation overshooting” policies will be of concern to Japan’s policymakers.

"It cannot be ruled out that the BoJ is being forced to pretend and extend policies which, had they been as effective as anticipated, would now be in the process of being wound down.”

Mr George is not alone in his stinging attack on the BoJ’s interventionist approach. Tom Becket, chief investment officer at Psigma, also reckons investors have every right to be frustrated with “plain random” measures that failed to achieve what they set out to do.

“Investors believe that the Bank of Japan’s experiment has failed and credibility in them has collapsed,” he says. “The yen has been unhelpfully strengthening and there is an argument that despite owning a terrifying amount of the bond market, they have lost control of the ‘long end’, judging by the rise of long-dated borrowing costs.

“The more recent decisions made in 2016 have seemed poorly thought out and plain random, particularly when the BoJ cut their deposit rate to -0.10 per cent, despite Kuroda-san [the BoJ’s governor] denying that he had contemplated such an action only a few days previously.”

With crisis comes opportunity

Such comments might seem enough to put anyone off investing in Japanese equities. Yet Mr Becket, influenced by the effect negative sentiment has had on valuations, contends that the action of central bankers shouldn’t undermine the merits of investing in a country now full of seemingly cheap stocks.

A closer look at the constituents of the Nikkei 225 index makes this temptation to buy on weakness understandable.

Despite horrid memories of its real estate and stock market collapse in the early 1990s, and uninspiring growth forecast today, few can dismiss the nation’s reputation for creating some of the world’s most famous companies and market-leading brands.

The likes of world-renowned companies such as Sony, Mitsubishi, Toyota, Honda, Panasonic and Nissan are all largely synonymous with quality and, perhaps more importantly, decades of success when their domestic economy was stuttering and technology rapidly evolved.

Given that Japan is capable of breeding those types of names means, according to respondents to this article, that the country's reputation for cutting-edge innovation and shrewd management should not be discredited.

Naturally, recent external events, such as Brexit’s effect on foreign exchange markets and the economic slowdowns of its biggest trading partners North America and China, do not make such credentials immune from hardship.

However, some analysts are now convinced that these challenges have been priced into most valuations.

“The yen’s appreciation and relentless stream of global growth revisions downward forced top-down forecasters to expect a profit drop of around 10 per cent for the current financial year,” says Jesper Koll, chief executive at WisdomTree Japan.

“The record wave of global investors cutting their Japan equity wave testifies that the negative earnings outlook has been acted upon already.”

Has the sell-off gone too far?

Nikko Asset Management’s chief investment officer Hiroki Tsujimura is even more bullish, claiming that rampant cost-cutting programmes will offset any impact a stronger yen might have.

That observation chimes with the summer’s reporting season. Japanese companies, which are no strangers to difficult times, mainly beat analyst estimates in a challenging period by slashing expenses and having manufacturing sites abroad.

Mr Tsujimura and his colleague John Vail reckon cautious management, and further government asset-buying sprees, are not reflected in price-to-earnings ratio, which lag other developed markets and are close to post-Abenomics lows.

Some commentators are uncomfortable endorsing an equity market where the central bank is the biggest whale, adding that this makes shares harder to trade and could crowd out shareholders keen to push for better corporate governance.

But Mr Vail offers a more positive take on the BoJ’s various interventionist actions. “Even though Japan’s economy is not very strong, this should not concern investors greatly,” he says.

“We believe that Abenomics is working reasonably well, especially for corporations, as second quarter pre-tax profit margins (on a four quarter average) remained near historical highs, despite the stronger yen. On an after-tax basis, the improvement is even better due to lower corporate taxes.”

Shaking up boardrooms

Lower corporate taxes are at the heart of Mr Abe’s business-friendly agenda. Slashing one of the developed world’s highest tax rates formed part of his pledge to encourage companies to invest more, hire extra staff and raise wages.

Higher dividends and share buybacks are part of a trend towards better shareholder returns in Japan.

Other measures introduced under his third and final “arrow” included cutting red tape, boosting productivity, getting increasing women into the workforce and improving governance.

The latter strategy, which involves persuading bosses to distribute more capital to shareholders, proved to be particularly popular among foreign investors.

Efforts to transform the corporate Japanese habit of sitting on cash appear to be working, too. Despite reports that many have been dragging their heels over the corporate governance code, a year after the policy was launched listed companies were credited for returning a record proportion of profits to investors.

Encouraging foreign influence in boardrooms might also have played a role in erasing a culture of stinginess and investment in questionable diversification projects.

Research shows that an increasing number of aggressive hedge fund managers are arriving from North America to rapidly shake up how the Japanese do business.

Return on equity, which measures how efficient businesses generate earnings from shareholder capital, is considerable lower in Japan than in the US, UK, Australia and Europe.

If anything, these activist investors are definitely capable of dictating how funds can be better spent, whether it is through smarter investment, mergers and acquisitions, share buybacks or generous dividends.

Dividends are becoming the norm

This potential has become a hot topic in income investing circles. “Japan is home to many profitable companies that have significant levels of cash on their balance sheets, but which have been relatively poor historically at distributing profits to shareholders,” says Ben Lofthouse, portfolio manager of Henderson’s global equity team.

“Dividends from Japanese companies grew rapidly in 2015 in local currency terms. And the recent strengthening of the Japanese yen – which additionally boosts returns for overseas holders of Japanese assets – has provided a further fillip.”

Talk of rapidly growing dividends will be well-received by most investors. But, as Mr Lofthouse correctly adds, these figures are flattered by weak comparatives, meaning that Japan’s fast rising payouts are still nowhere near the heights of the more established income-paying nations.

"The market only yields around 2 per cent at present, and with only 10.7 per cent of the Japanese market expected to yield more than 3 per cent looking ahead 12 months, it is proving challenging to find companies with an attractive dividend yield,” he says.

If that wasn’t enough, Mr Lofthouse also warns that the Japanese custom of fixing payout ratios to percentage of earnings can make these comparatively small dividends volatile.

For those reasons his income trust currently has a limit exposure to the country, although he expects that to change once the reforms take hold and a dividend culture becomes more embedded.

Schroders fund manager Nathan Gibbs is similarly keeping a careful eye on the nation’s increasingly shareholder-friendly culture, even if he, too, remains cautious at this stage.

“Higher dividends and share buybacks are part of a trend towards better shareholder returns in Japan,” Mr Gibbs says.

“Having said that, current conditions are particularly favourable as corporate Japan continues to generate high levels of cash, allowing many companies to increase shareholder pay-outs while still adding to cash on their balance sheets.

"To truly judge whether the attitude to shareholders has changed long-term, we will need to see how companies react in a more difficult period, or in a recessionary environment.”

Small-caps fall under the radar

Another area of the Japanese stock market that’s attracting Mr Gibbs’ attention is the small-cap space. Smaller companies in the land of the rising sun have enjoyed a revival in recent times, as most sell their products domestically, and are subsequently less impacted by the strengthening yen and turbulence in overseas markets.

Bulls could argue that they are also more likely to capture new growth opportunities in an economy undergoing structural change, and are better equipped to adapt culturally to appease foreign investors – a point that already appears to have been picked up by activist investors.

With that in mind, Mr Gibbs’ claim that they’re being overlooked is an interesting one.

“Given the relatively inefficient nature of small-cap research in Japan, it is almost always worth delving into small-cap stocks,” he says.

“Many stocks fall off investors’ radar screens and become undervalued, resulting in significant valuation dispersion within the small-cap universe. Independent, disciplined research in this area of the market, resulting in high-conviction non-consensus views on individual stocks, can often add more value than in [the] large-cap arena.”

Of course, whether clients choose to follow this advice will depend on their faith in Japan’s economy and Mr Abe’s ability to deliver on his promises.

Domestically-focused small-caps tend to mirror the health of the country they hail from, so it is important that an investor buys into the government’s drive to get its ageing, shrinking population to spend more.

Advocates are adamant that the structural reforms introduced by Mr Abe will come good over time, and have been unfairly hindered by economic uncertainty across key trading nations. In opposition, critics argue that Abenomics’ time is up.

Those investors who prefer to take the patient view should be prepared to encounter plenty more turbulence in the coming years.

As is regularly the case with value investing, sentiment can be very volatile before the underlying benefits fully register with sceptical markets.

Mr Abe will be hoping that his experimental, often maligned strategy to bring Japan back from the brink of collapse follows a similar path.

Daniel Liberto is a freelance financial journalist

Japan investment trusts lure hungry investors

Japan investment trusts have stormed the charts over the past month, with investors showing renewed confidence in the performance of Japanese corporates.

According to QuotedData's latest investment companies round up, September saw renewed interest in Japanese investment trusts.

This coincided with strong outperformance from trusts such as Baillie Gifford Shin Nippon, Fidelity Japanese Values and JPMorgan Japanese.

These trusts were among the top-ten best performers over September, the data revealed, with the Baillie Gifford Shin Nippon investment trust gaining +10.5 per cent in net asset value (NAV) terms, putting it in pole position.

Although the Bank of Japan could well end up tightening liquidity at some point, other fundamentals remain supportive.

Also according to the research, NAVs were generally "pretty strong" in September, with very few investment trusts reporting drops in their NAV.

Top 10 best performers (September 2016)

Baillie Gifford Shin Nippon +10.5%

BlackRock World Mining +9.2%

UIL +9.0%

Fidelity Japanese Values +8.0%

JPMorgan Japanese +7.7%

Crystal Amber +7.4%

International Biotechnology +7.4%

Golden Prospect Precious Metals +7.1%

VietNam Holding +6.2%

BlackRock Commodities Income +5.8%

Source: QuotedData

This came after another Baillie Gifford investment trust, the growth-focused Baillie Gifford Japan Trust, reported strong year-on-year returns of 25.5 per cent NAV.

In the year ending 31 August 2016, the trust also reported a share price total return of 16.3 per cent, against the total return of the benchmark index - the Topix - which returned 21.5 per cent in sterling.

In a statement to the markets, the managers of the Baillie Gifford Japan Trust said the strong absolute return figures in NAV terms had been bolstered by the increase in the value of the yen.

Over the period, the yen rose 37.6 per cent to ¥135.5 per £1, which had last been seen in 2012, before the advent of Abenomics and a stricter fiscal policy environment in Japan.

The statement said: "The Japanese stock market fell in yen terms by 18.9 per cent as there were global worries, particularly about Chinese growth, and the impact of a stronger yen also affected projections for earnings.

"However, the trust's investment in secular growth companies such as Misumi has been helpful. Misumi, which has been in the portfolio for over ten years, has contributed the most to overall performance."

The managers also cited several internet-related companies, such as online fashion retailer Start Today, as having contributed to positive performance for the trust.

FTAdviser has reported that wealth managers and investment houses are starting to increase their holdings to Japanese equities against a global backdrop of political and increasing economic uncertainty.

Earlier this month, Luca Paolini, chief strategist at Pictet Asset Management, said the team was maintaining an overweight to Japanese equities.

He said: "We continue to be positive about Japanese shares. Although the Bank of Japan could well end up tightening liquidity at some point, other fundamentals remain supportive."